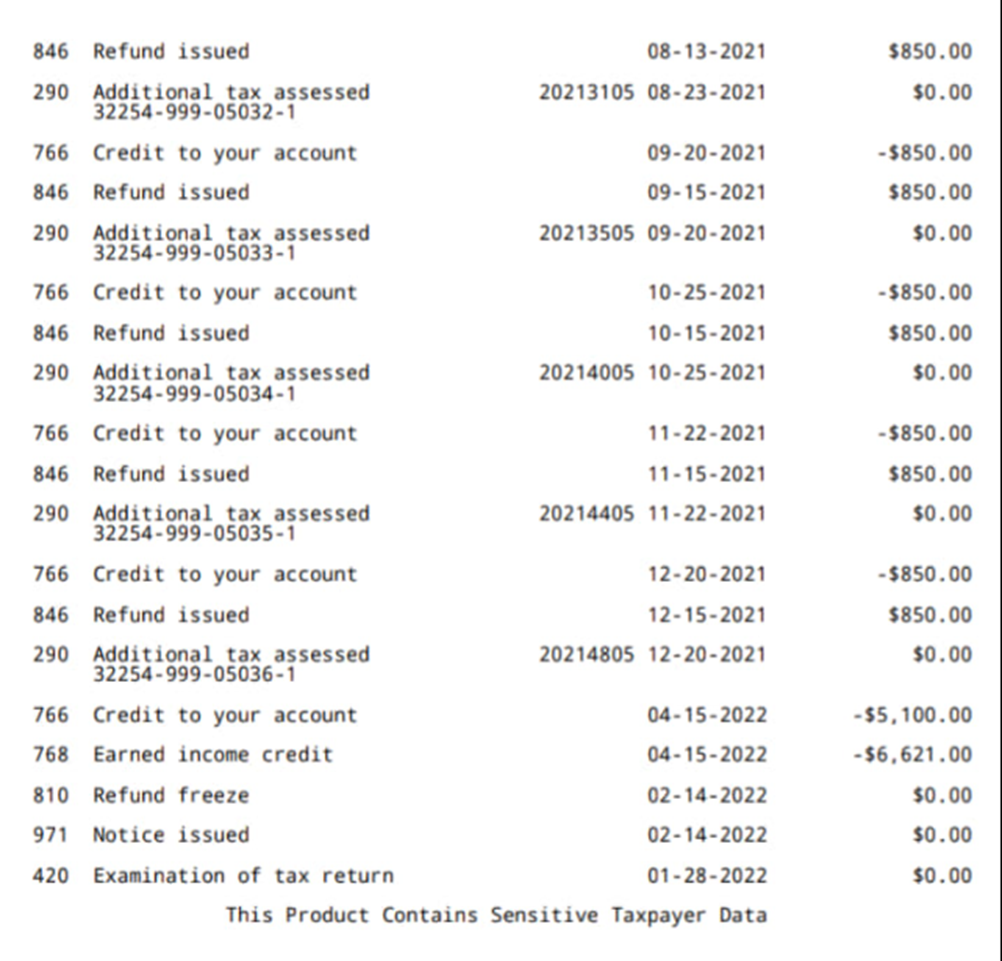

additional tax assessed by examination

Assesses additional tax as a result of an Examination or. Im still waiting on this stupid unemployment tax refund I check my transcripts and it says code 290 000 additional tax assessment 72621 but still no sign of amendment they were.

Statement From The Treasury Department March 1 1924 Madam C J Walker Indiana Historical Society Digital Images

TC 276 - Failure to Pay Tax.

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

. 1 If upon examination of any returns or from other information obtained by the department it appears that a tax or penalty has been paid less than that properly due the department shall. 575 rows Additional tax assessed by examination. It may be disputed.

Additional tax assessed by examination. I obtained a transcript of the tax return which shows no taxable. TC 196 - Interest Assessed.

For the past decade the IRS has seen an increase in the number of returns filed as well as a decrease in resources available for examinations for example in Fiscal Year FY. Possibly you left income off. On September 16 2019 the IRS assessed an additional tax of 2545 without a letter of explanation or change.

TC 150 - Date of filing and the amount of tax shown on the taxpayers return when filed - or as corrected by the IRS when processed. The examination of returns and the assessment of additional taxes penalties and interest shall be as provided by the State Tax Uniform Procedure Law RS5448-1 et seq except as. Additional Tax or Deficiency Assessment.

I filed an injured spouse from and my account was adjusted. Yes if the IRS identifies. A month later I.

What does additional tax assessed 09254-587-08904-6 mean with a cycle date 20162705. The examination of returns and the assessment of additional taxes penalties and interest shall be as provided by the State Tax Uniform Procedure Law 5448-1 et seq except as specifically. Additional Tax or Deficiency Assessment by Examination Div.

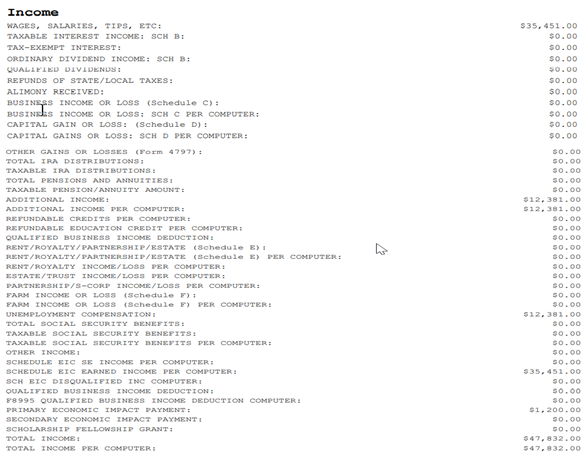

Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. After deductions our taxable income was 43342. August 11 2022.

83 rows Employees in Accounts Management respond to taxpayer inquiries. Hello In the year of 2018 My wife and I filed jointly. We payed 5610 in federal taxes.

The Court of Final Appeal held that a corporation instead of its directors is required to file a profits tax return pursuant to the Inland Revenue Ordinance IRO. An examination of a tax year after the statute of limitations is expired is an unnecessary examination because generally no assessment of tax can be made. If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax.

You understated your income by more that 25 When a taxpayer.

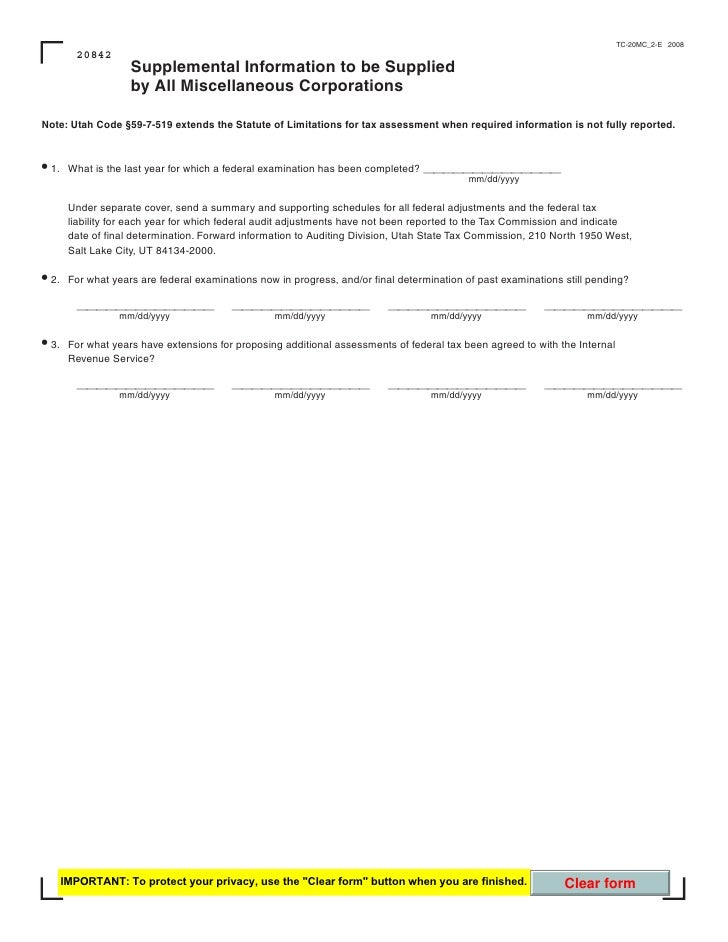

Tax Utah Gov Forms Current Tc Tc 20mc

Chapter 18 Final Exam Act 330 Introduction To Taxation Quizzes Business Taxation And Tax Management Docsity

Connerton Elementary On Twitter Attention Parents Of Incoming Kindergarten Parents Please Read The Kindergarten Registration Flyer For Important Reminders Of Dates Documents To Bring And A Qr Code To Fill Out With

Meaning Of Irs Tax Transaction Codes On Wmr Irs2go And Account Transcript For Your Tax Return And Refund Status 150 151 152 203 420 421 570 846 898 971 1121 1161 Aving To Invest

Where S My Refund 2020 2021 Tax Refund Stimulus Updates On My Transcripts It Shows That My Refund Had A Freeze Code 810 But Then Also Shows Tax Code 811 They Released

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Irs Transaction Codes Ths Irs Transcript Tools

Irs Transaction Codes And Error Codes On Transcripts

Top Irs Audit Triggers Bloomberg Tax

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

1 Providence Catholic High School

Today Is Transcripttuesday Use This Where S My Refund Facebook

Trends In The Internal Revenue Service S Funding And Enforcement Congressional Budget Office

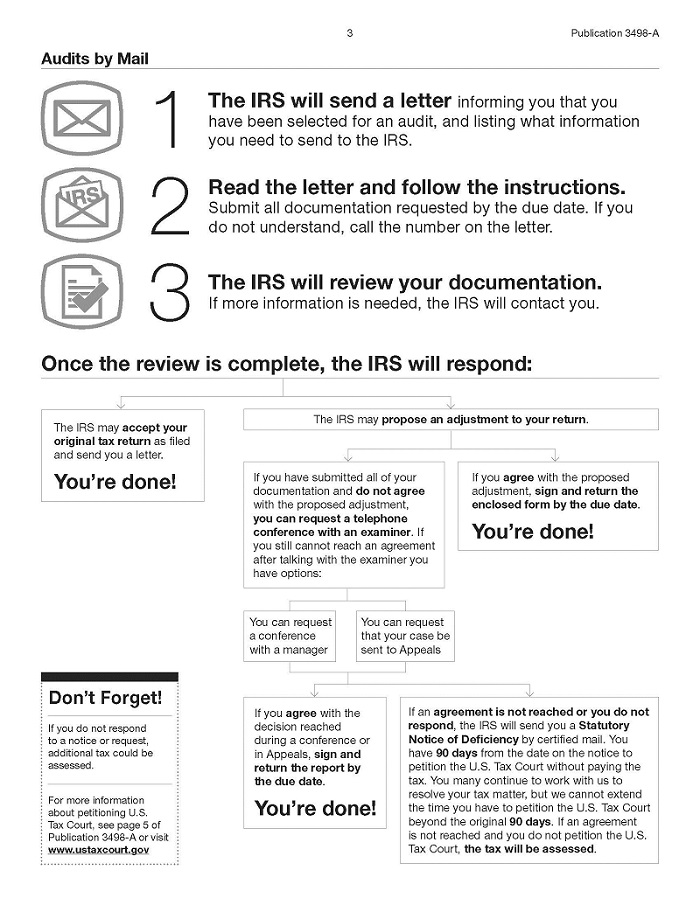

Audits By Mail Taxpayer Advocate Service

Irs Account Transcript Help R Irs